South East States’ Contributions to VAT Pool and Benefits Received (January to October 2024)

Anambra

Contributed: N40.13bn

Received: N63.35bn (157.9%)Ebonyi

Contributed: N21.98bn

Received: N49.97bn (227.3%)Enugu

Contributed: N12.99bn

Received: N54.76bn (421.4%)Abia

Contributed: N6.50bn

Received: N51.59bn (793.1%)Imo

Contributed: N3.33bn

Received: N57.22bn (1,715.9%)

A Detailed Analysis

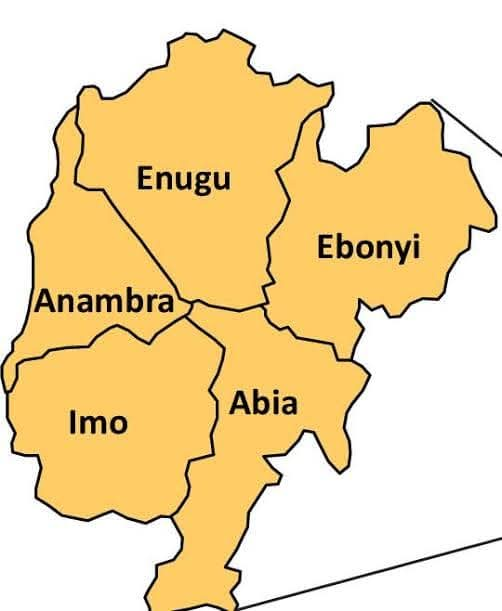

The South East states in Nigeria have made significant contributions to the Value Added Tax (VAT) pool between January and October 2024. According to the latest data, the six states in the region have collectively contributed billions of naira to the VAT pool, with some states receiving more than 1,700% of their contributions in benefits. In this report, we will delve into the details of each state’s contribution and benefits received, as well as the implications of these figures for the region’s economy.

Anambra State: A Significant Contributor to the VAT Pool

Anambra State has emerged as one of the top contributors to the VAT pool in the South East region. Between January and October 2024, the state contributed a total of N40.13 billion to the VAT pool. This is a significant amount, considering that Anambra State is one of the smallest states in Nigeria by land area.

Despite its relatively small size, Anambra State has a thriving economy, driven by its vibrant commercial and industrial sectors. The state is home to the popular Onitsha Market, one of the largest markets in West Africa. The market attracts thousands of traders and customers from all over the country, generating significant revenue for the state government.

In return for its significant contribution to the VAT pool, Anambra State received a total of N63.35 billion in benefits between January and October 2024. This represents a 157.9% return on the state’s contribution, making it one of the top beneficiaries of the VAT pool in the South East region.

Ebonyi State: A Notable Increase in VAT Contributions

Ebonyi State has also made significant contributions to the VAT pool between January and October 2024. The state contributed a total of N21.98 billion to the VAT pool during this period, representing a notable increase from previous years.

Ebonyi State’s economy is driven by its agricultural sector, with the state being one of the largest producers of rice, yams, and cassava in Nigeria. The state is also home to several mineral resources, including limestone, marble, and granite.

In return for its contributions to the VAT pool, Ebonyi State received a total of N49.97 billion in benefits between January and October 2024. This represents a 227.3% return on the state’s contribution, making it one of the top beneficiaries of the VAT pool in the South East region.

Enugu State: A Thriving Economy Driven by Commerce and Industry

Enugu State has a thriving economy driven by its vibrant commercial and industrial sectors. The state is home to several major markets, including the Ogbete Market and the New Market, which attract thousands of traders and customers from all over the country.

Between January and October 2024, Enugu State contributed a total of N12.99 billion to the VAT pool. This is a significant amount, considering that Enugu State is one of the smaller states in Nigeria by land area.

In return for its contributions to the VAT pool, Enugu State received a total of N54.76 billion in benefits between January and October 2024. This represents a 421.4% return on the state’s contribution, making it one of the top beneficiaries of the VAT pool in the South East region.

Abia State: A Significant Increase in VAT Benefits

Abia State has also made significant contributions to the VAT pool between January and October 2024. The state contributed a total of N6.50 billion to the VAT pool during this period, representing a significant increase from previous years.

Abia State’s economy is driven by its commercial and industrial sectors, with the state being home to several major markets and industries. The state is also known for its vibrant cultural scene, with several festivals and events taking place throughout the year.

In return for its contributions to the VAT pool, Abia State received a total of N51.59 billion in benefits between January and October 2024. This represents a 793.1% return on the state’s contribution, making it one of the top beneficiaries of the VAT pool in the South East region.

Imo State: A Notable Increase in VAT Contributions and Benefits

Imo State has also made significant contributions to the VAT pool between January and October 2024. The state contributed a total of N3.33 billion to the VAT pool during this period, representing a notable increase from previous years.

Imo State’s economy is driven by its agricultural sector, with the state being one of the largest producers of rice, yams, and cassava in Nigeria. The state is also home to several mineral resources, including limestone, marble, and granite.

In return for its contributions to the VAT pool, Imo State received a total of N57.22 billion in benefits between January and October 2024. This represents a 1,715.9% return on